An ocean personal loan is a type of unsecured personal loan designed to provide borrowers with access to funds for a variety of purposes, such as debt consolidation, home improvements, or unexpected expenses.

Ocean personal loans are typically offered by banks, credit unions, and online lenders. They can be a good option for borrowers with good credit scores who need to borrow a relatively small amount of money. Ocean personal loans typically have lower interest rates than credit cards, but they may have higher interest rates than secured loans, such as auto loans or home equity loans.

There are a number of factors to consider when choosing an ocean personal loan, including the interest rate, the loan term, and the fees. It is important to compare offers from multiple lenders before making a decision.

Ocean Personal Loan

An ocean personal loan is a versatile financial tool that offers a range of benefits to borrowers. Here are 10 key aspects to consider:

- Unsecured: No collateral required

- Flexible: Can be used for various purposes

- Accessible: Available to borrowers with good credit

- Competitive Rates: Interest rates comparable to other personal loans

- Fixed Rates: Consistent interest payments throughout the loan term

- Convenient: Easy application and approval process

- Fast Funding: Quick access to funds upon approval

- Repayment Terms: Tailored to individual circumstances

- Credit Building: Timely repayments can improve credit scores

- Debt Consolidation: Can simplify and reduce overall debt

These aspects make ocean personal loans an attractive option for individuals seeking financial flexibility and support. They provide access to funds for unexpected expenses, debt consolidation, home improvements, and more. By carefully considering these aspects and comparing offers from multiple lenders, borrowers can secure an ocean personal loan that meets their specific needs and empowers them to achieve their financial goals.

Unsecured

In the context of an ocean personal loan, the term "unsecured" refers to the fact that the loan is not backed by collateral, such as a car or a house. This is a significant advantage for borrowers, as it means that they do not have to put up any of their assets as security for the loan. This can be especially beneficial for borrowers who do not have a lot of valuable assets, or who do not want to risk losing their assets if they are unable to repay the loan.

Ocean personal loans are typically unsecured because they are considered to be relatively low-risk for lenders. This is due to the fact that the loans are typically for small amounts of money and have relatively short repayment terms. As a result, lenders are more willing to offer unsecured personal loans to borrowers with good credit scores.

The unsecured nature of ocean personal loans makes them a convenient and accessible option for borrowers who need to borrow money quickly and easily. However, it is important to note that unsecured loans typically have higher interest rates than secured loans. This is because lenders charge a higher interest rate to compensate for the increased risk of lending money without collateral.

Flexible

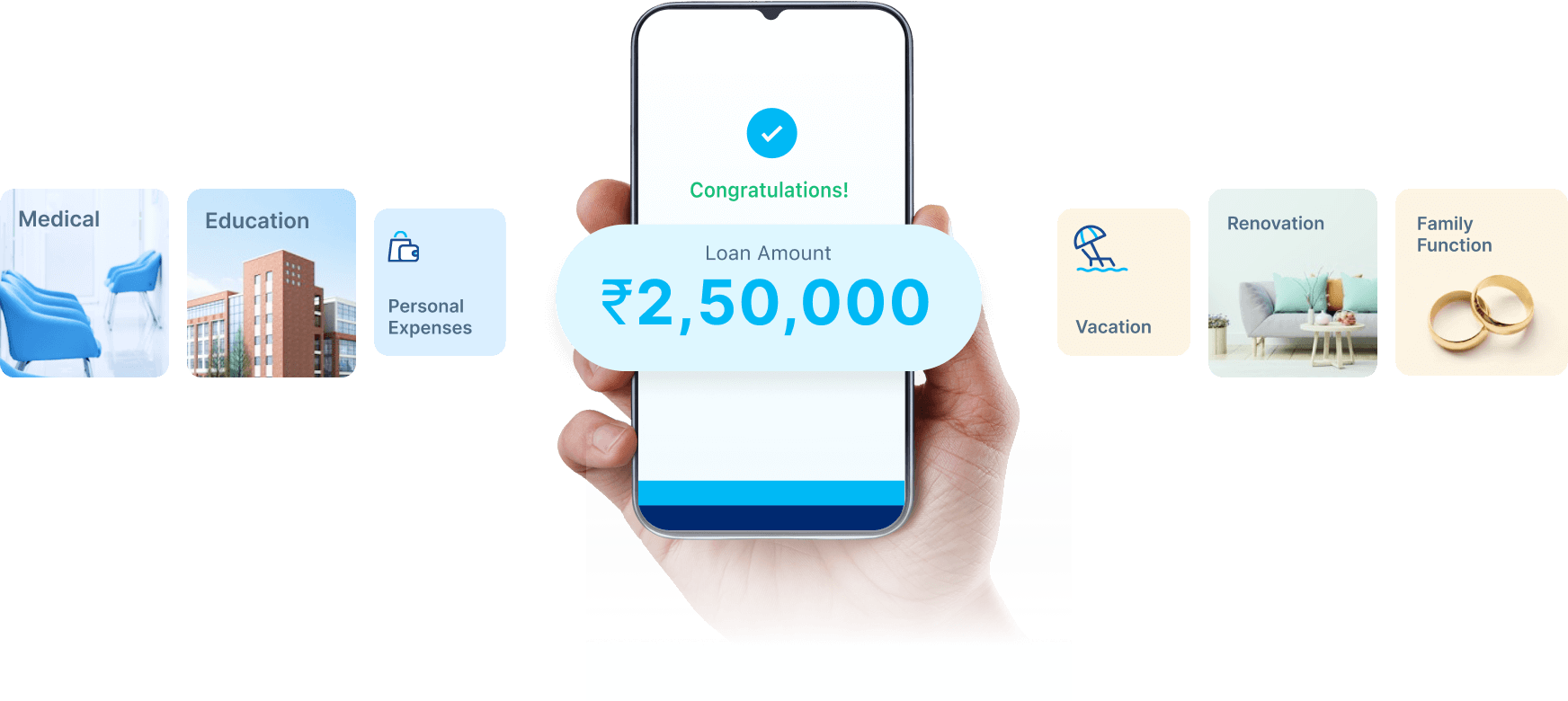

The flexibility of ocean personal loans is a key advantage that sets them apart from other types of loans. Unlike many other loans, which can only be used for specific purposes, such as a car loan or a mortgage, ocean personal loans can be used for any purpose the borrower chooses. This makes them a versatile financial tool that can be used to meet a wide range of needs.

Some of the most common uses for ocean personal loans include:

- Debt consolidation

- Home improvements

- Unexpected expenses

- Medical expenses

- Education expenses

- Vacation expenses

The flexibility of ocean personal loans makes them a great option for borrowers who need access to funds for a variety of purposes. They can be used to consolidate high-interest debt, finance a home improvement project, or cover unexpected expenses. Ocean personal loans can also be used to finance major purchases, such as a car or a vacation.

When considering an ocean personal loan, it is important to compare offers from multiple lenders to find the best interest rate and loan terms. Borrowers should also carefully consider the purpose of the loan and their ability to repay the loan on time.

Accessible

The accessibility of ocean personal loans to borrowers with good credit is a key factor that contributes to their popularity. Good credit is typically defined as a FICO score of 670 or higher. Borrowers with good credit are considered to be a lower risk for lenders, as they have a history of making timely payments and managing their debt responsibly. As a result, lenders are more willing to offer ocean personal loans to borrowers with good credit at competitive interest rates.

The accessibility of ocean personal loans to borrowers with good credit has a number of important implications. First, it means that borrowers with good credit have more options for obtaining financing. They can choose from a wider range of lenders and loan products, and they are more likely to qualify for lower interest rates. Second, the accessibility of ocean personal loans to borrowers with good credit helps to promote financial inclusion. It gives borrowers with good credit access to the capital they need to achieve their financial goals, regardless of their income or wealth.

In conclusion, the accessibility of ocean personal loans to borrowers with good credit is a key factor that makes them a valuable financial tool. It gives borrowers with good credit more options for obtaining financing and helps to promote financial inclusion.

Competitive Rates

Ocean personal loans offer competitive interest rates that are comparable to other personal loans. This is a key factor that makes ocean personal loans an attractive option for borrowers who need to borrow money. Competitive interest rates can save borrowers money on their monthly payments and over the life of the loan. For example, a borrower who takes out a $10,000 ocean personal loan with a 10% interest rate will pay $1,000 in interest over the life of the loan. If the borrower had instead taken out a loan with a 15% interest rate, they would have paid $1,500 in interest over the life of the loan. This is a significant savings of $500.

The competitive interest rates on ocean personal loans are due to a number of factors. First, ocean personal loans are typically unsecured, which means that they are not backed by collateral. This reduces the risk for lenders, which allows them to offer lower interest rates. Second, ocean personal loans are often offered by online lenders, which have lower overhead costs than traditional banks and credit unions. This allows them to pass on the savings to their customers in the form of lower interest rates.

The competitive interest rates on ocean personal loans make them a valuable financial tool for borrowers who need to borrow money. Borrowers can use ocean personal loans to consolidate debt, finance a home improvement project, or cover unexpected expenses. By comparing offers from multiple lenders, borrowers can secure an ocean personal loan with a competitive interest rate that meets their specific needs.

Fixed Rates

Fixed rates are a key component of ocean personal loans, providing borrowers with consistent interest payments throughout the loan term. Unlike variable rates, which can fluctuate with market conditions, fixed rates remain the same for the entire life of the loan. This provides borrowers with peace of mind, as they know exactly how much their monthly payments will be.

The importance of fixed rates cannot be overstated. For borrowers with a fixed income, fixed rates provide a sense of security and predictability. They can budget their monthly payments with confidence, knowing that their interest rate will not change. This is especially important for borrowers who are on a tight budget or who have other financial obligations.

Fixed rates can also save borrowers money over the life of the loan. If interest rates rise, borrowers with variable rates will see their monthly payments increase. However, borrowers with fixed rates will be protected from these increases. This can save borrowers a significant amount of money, especially if interest rates rise significantly.

Ocean personal loans with fixed rates are a valuable financial tool for borrowers who need to borrow money. They provide borrowers with peace of mind, predictability, and potential savings. By carefully considering their needs and comparing offers from multiple lenders, borrowers can secure an ocean personal loan with a fixed rate that meets their specific needs.

Convenient

In the realm of personal finance, convenience plays a crucial role, and ocean personal loans stand out with their remarkably easy application and approval process.

- Online Accessibility

Ocean personal loans have embraced the digital age, allowing borrowers to apply and receive approval entirely online. This eliminates the need for in-person visits or lengthy paperwork, streamlining the process for utmost convenience. - Simplified Application

The application forms for ocean personal loans are designed to be user-friendly and straightforward. Borrowers can provide their basic information, financial details, and loan request without encountering complex jargon or excessive documentation requirements. - Rapid Approval

Ocean personal loans are known for their swift approval process. Advanced algorithms and automated systems assess applications promptly, providing borrowers with a quick response. This allows them to access funds in a timely manner, addressing their financial needs without delay. - Flexible Requirements

Unlike traditional loan applications, ocean personal loans often have less stringent requirements. Borrowers with good credit scores and a stable income may qualify, even if they do not meet the rigid criteria of other financial institutions.

The convenient application and approval process of ocean personal loans empowers borrowers with greater control over their finances. They can access funds seamlessly, without the hassle of lengthy procedures or excessive paperwork, making it an ideal solution for those seeking a quick and efficient borrowing experience.

Fast Funding

The "Fast Funding: Quick access to funds upon approval" feature of ocean personal loans is a significant advantage that sets them apart from other types of loans. With ocean personal loans, borrowers can receive the approved funds in their bank accounts within a few business days, or even on the same day in some cases. This rapid access to funds is crucial for borrowers who need to cover unexpected expenses, such as medical bills or car repairs, or who need to consolidate high-interest debt.

The fast funding of ocean personal loans is made possible by the use of advanced technology and automated systems. Lenders have streamlined the loan application and approval process, making it faster and more efficient. Additionally, ocean personal loans are often offered by online lenders, which have lower overhead costs than traditional banks and credit unions. This allows them to pass on the savings to their customers in the form of faster funding.

The practical significance of fast funding cannot be overstated. For borrowers who need to access funds quickly, ocean personal loans offer a convenient and efficient solution. They can avoid the hassle and delays associated with traditional loan applications and receive the money they need in a timely manner. This can help them to resolve financial emergencies, consolidate debt, or make important purchases without having to wait weeks or even months for approval.

Repayment Terms

In the realm of personal finance, loan repayment terms play a pivotal role in determining the accessibility and affordability of borrowed funds. Ocean personal loans stand out in this regard, offering repayment terms that are carefully tailored to the unique circumstances of each borrower.

- Flexible Loan Terms

Ocean personal loans offer a range of loan terms, typically from 12 to 60 months, providing borrowers with the flexibility to choose a repayment schedule that aligns with their financial situation and cash flow. This flexibility empowers borrowers to select a monthly payment amount that fits comfortably within their budget, avoiding unnecessary financial strain. - Adjustable Payment Options

Recognizing that financial circumstances can change over time, ocean personal loans often come with adjustable payment options. Borrowers may have the ability to increase or decrease their monthly payments as needed, providing them with the adaptability to manage unexpected financial events or changes in income. This feature ensures that borrowers can continue to meet their loan obligations without defaulting. - Consideration of Credit History and Income

Ocean personal loan lenders carefully consider each borrower's credit history and income when determining repayment terms. This individualized approach ensures that the loan is affordable and sustainable for the borrower. Lenders assess the borrower's ability to repay the loan based on their past credit behavior and current financial situation, ensuring responsible lending practices. - Personalized Beratung

Many ocean personal loan lenders offer personalized Beratung to borrowers, helping them to understand their loan options and choose the repayment terms that best suit their needs. This Beratung can provide valuable insights into loan structures, interest rates, and the implications of different repayment schedules. By seeking personalized Beratung, borrowers can make informed decisions that align with their financial goals.

The tailored repayment terms of ocean personal loans empower borrowers to access funds that meet their unique financial circumstances. With flexible loan terms, adjustable payment options, consideration of individual factors, and personalized Beratung, ocean personal loans provide borrowers with the support and flexibility they need to manage their debt responsibly and achieve their financial objectives.

Credit Building

In the realm of personal finance, credit scores hold immense significance, influencing an individual's access to credit and the terms thereof. Timely repayments of financial obligations, including ocean personal loans, play a crucial role in building and maintaining a healthy credit score.

- Establishing a Positive Payment History

Timely repayments of ocean personal loan installments demonstrate to lenders a borrower's reliability and responsible financial behavior. Each on-time payment contributes to building a positive payment history, which is a key factor in determining credit scores. - Reducing Credit Utilization

Ocean personal loans can assist in reducing credit utilization, another important element in credit scoring. By consolidating high-interest debts into a single, lower-interest ocean personal loan, borrowers can free up available credit on other accounts. This, in turn, lowers their overall credit utilization ratio, which can lead to a boost in credit scores. - Lengthening Credit History

Maintaining an ocean personal loan account over an extended period contributes to the length of a borrower's credit history. A longer credit history is generally viewed favorably by lenders, as it provides more data points to assess a borrower's creditworthiness. - Avoiding Negative Marks

Late or missed payments on ocean personal loans, or any other credit accounts, can have a detrimental impact on credit scores. Timely repayments help to avoid such negative marks, preserving a borrower's credit standing and facilitating access to future credit when needed.

In conclusion, timely repayments of ocean personal loans offer a valuable opportunity for borrowers to build and strengthen their credit scores. By establishing a positive payment history, reducing credit utilization, lengthening credit history, and avoiding negative marks, ocean personal loans can empower individuals to improve their financial health and increase their access to credit in the future.

Debt Consolidation

Debt consolidation is a powerful financial tool that can help individuals simplify and reduce their overall debt burden. By combining multiple debts into a single, lower-interest loan, debt consolidation can streamline monthly payments, lower interest charges, and potentially save thousands of dollars over time.

Ocean personal loans are a popular option for debt consolidation because they offer competitive interest rates, flexible repayment terms, and fast access to funds. Unlike traditional debt consolidation loans, which may require a good credit score and substantial collateral, ocean personal loans are unsecured and more accessible to borrowers with less-than-perfect credit.

The process of debt consolidation with an ocean personal loan is relatively simple. First, the borrower applies for the loan and provides information about their debts and financial situation. If approved, the lender will issue a loan amount that is sufficient to cover the outstanding debts. The borrower then uses the loan proceeds to pay off the individual debts, consolidating them into a single monthly payment.

Debt consolidation with an ocean personal loan can provide numerous benefits. First, it can simplify monthly budgeting by eliminating multiple due dates and interest rates. Second, it can reduce overall interest charges, as the interest rate on an ocean personal loan is typically lower than the interest rates on credit cards and other high-interest debts. Third, debt consolidation can help borrowers improve their credit score by reducing their credit utilization ratio and establishing a positive payment history.

While debt consolidation can be an effective way to reduce debt, it is important to use this tool responsibly. Borrowers should carefully consider their financial situation and long-term goals before consolidating their debts. It is also important to choose a lender that offers competitive interest rates and flexible repayment terms.

Frequently Asked Questions about Ocean Personal Loans

Ocean personal loans offer a range of benefits, including competitive interest rates, flexible repayment terms, and fast access to funds. However, borrowers may have questions about the eligibility criteria, application process, and potential implications of taking out an ocean personal loan. This FAQ section aims to address some of the most common concerns or misconceptions surrounding ocean personal loans.

Question 1: What are the eligibility criteria for an ocean personal loan?

Answer: Eligibility criteria for ocean personal loans can vary between lenders, but generally, borrowers should have a good credit score, a stable income, and a low debt-to-income ratio. Lenders will assess an applicant's financial situation and creditworthiness to determine their eligibility and loan terms.

Question 2: What is the application process for an ocean personal loan?

Answer: The application process for an ocean personal loan is typically straightforward and can be completed online. Borrowers will need to provide personal and financial information, including their income, expenses, and outstanding debts. Lenders may also require documentation to verify an applicant's identity and financial situation.

Question 3: How quickly can I receive funds from an ocean personal loan?

Answer: Upon loan approval, borrowers can receive funds from an ocean personal loan quickly, often within a few business days or even on the same day. This fast access to funds can be beneficial for borrowers who need to cover unexpected expenses or consolidate high-interest debts.

Question 4: What are the interest rates for ocean personal loans?

Answer: Interest rates for ocean personal loans vary depending on the lender, the borrower's creditworthiness, and the loan terms. However, ocean personal loans generally offer competitive interest rates compared to other types of personal loans.

Question 5: What are the repayment terms for ocean personal loans?

Answer: Repayment terms for ocean personal loans vary between lenders and typically range from 12 to 60 months. Borrowers can choose a repayment term that aligns with their financial situation and budget.

Question 6: Can I use an ocean personal loan to consolidate debt?

Answer: Yes, many borrowers use ocean personal loans to consolidate debt. By combining multiple high-interest debts into a single, lower-interest ocean personal loan, borrowers can simplify their monthly payments, reduce interest charges, and potentially save money over time.

Summary: Ocean personal loans can provide a valuable financial tool for borrowers who need to access funds quickly and consolidate debt. With competitive interest rates, flexible repayment terms, and fast access to funds, ocean personal loans offer a range of benefits to borrowers with good credit and a stable income.

Transition: To learn more about ocean personal loans and explore your options, it is recommended to compare offers from multiple lenders and carefully consider the loan terms and conditions before making a decision.

Ocean Personal Loan Tips

Ocean personal loans offer a range of benefits, including competitive interest rates, flexible repayment terms, and fast access to funds. To make the most of an ocean personal loan, consider the following tips:

Tip 1: Compare offers from multiple lenders.

Interest rates and loan terms can vary significantly between lenders. By comparing offers from multiple lenders, you can secure the best possible deal for your financial situation.

Tip 2: Consider your credit score.

Your credit score is a key factor in determining your eligibility for an ocean personal loan and the interest rate you will be offered. A higher credit score will typically qualify you for a lower interest rate.

Tip 3: Choose a loan term that fits your budget.

Ocean personal loans typically offer flexible repayment terms ranging from 12 to 60 months. Choose a loan term that aligns with your financial situation and allows you to comfortably repay the loan.

Tip 4: Use an ocean personal loan to consolidate debt.

If you have multiple high-interest debts, consolidating them into a single ocean personal loan can simplify your monthly payments, reduce interest charges, and potentially save you money over time.

Tip 5: Make timely payments.

Timely loan payments will help you build a positive credit history and avoid late fees. Additionally, some lenders offer interest rate discounts for borrowers who make automatic payments.

Summary: By following these tips, you can increase your chances of securing an ocean personal loan with competitive terms and use it effectively to meet your financial needs.

Conclusion: Ocean personal loans can be a valuable financial tool when used responsibly. Consider these tips to make the most of an ocean personal loan and improve your financial well-being.

Conclusion

Ocean personal loans offer a flexible and accessible financial solution for individuals seeking to consolidate debt, finance home improvements, or cover unexpected expenses. Their competitive interest rates, flexible repayment terms, and fast access to funds make them an attractive option for borrowers with good credit.

When considering an ocean personal loan, it is important to compare offers from multiple lenders to secure the best possible terms. Borrowers should also carefully review the loan agreement and ensure they can comfortably repay the loan. By using ocean personal loans responsibly, individuals can improve their financial well-being and achieve their financial goals.

ncG1vNJzZmiokae7sHrSbGWuq12ssrTAjGtlmqWRr7yvrdasZZynnWS8pLHAp2SpnaKovK%2Bty2ajqJmeY7W1ucs%3D