Rainer Schaller Net Worth refers to the estimated value of the assets and wealth accumulated by Rainer Schaller, a German entrepreneur and investor. It encompasses his personal fortune, investments, and business holdings.

Schaller's net worth gained significant attention due to his successful ventures in the fitness industry, particularly through the founding of the global fitness chain McFit. His entrepreneurial acumen and strategic investments have contributed to the growth of his wealth over the years.

Understanding Rainer Schaller's net worth provides insights into the financial success and business achievements of a notable entrepreneur in the fitness sector. It highlights the potential for wealth creation and the impact of strategic investments in growing industries.

Rainer Schaller Net Worth

Rainer Schaller's net worth is a reflection of his entrepreneurial success and strategic investments. Key aspects that contribute to his wealth include:

- Fitness Industry Pioneer

- McFit Founder and CEO

- Global Fitness Chain

- Real Estate Holdings

- Venture Capital Investments

- Private Equity Investments

- Philanthropy and Social Impact

- Financial Discipline

- Calculated Risk-Taking

- Long-Term Vision

Schaller's entrepreneurial journey in the fitness industry, particularly through McFit, has been instrumental in building his wealth. His ability to identify market opportunities and execute strategic expansion plans has contributed to the growth of McFit into a global fitness chain. Additionally, his investments in real estate, venture capital, and private equity have further diversified his portfolio and increased his net worth.

Fitness Industry Pioneer

The connection between "Fitness Industry Pioneer" and "Rainer Schaller Net Worth" lies in the success of Schaller's entrepreneurial ventures within the fitness sector. As a pioneer in the industry, Schaller recognized the growing demand for accessible and affordable fitness facilities. His vision led him to establish McFit, a chain of low-cost fitness clubs that revolutionized the fitness landscape in Germany and beyond.

McFit's success played a pivotal role in Schaller's wealth creation. Under his leadership, McFit expanded rapidly, becoming one of the largest fitness chains in Europe. The company's focus on providing high-quality fitness services at an affordable price resonated with a wide customer base, leading to significant revenue growth and profitability.

Furthermore, Schaller's status as a fitness industry pioneer attracted investors and business partners, which further contributed to his net worth. His expertise and reputation opened doors to new opportunities, allowing him to diversify his investments and expand his business interests.

McFit Founder and CEO

The connection between "McFit Founder and CEO" and "Rainer Schaller Net Worth" lies in the pivotal role McFit has played in building Schaller's wealth. As the founder and CEO of McFit, Schaller has been instrumental in the company's growth and success, which has directly contributed to his net worth.

Under Schaller's leadership, McFit has become one of the largest fitness chains in Europe, with over 250 locations in several countries. The company's success can be attributed to its unique business model, which focuses on providing affordable and accessible fitness services to a broad customer base. McFit's low-cost membership fees and convenient locations have made it a popular choice for budget-conscious fitness enthusiasts.

The financial success of McFit has significantly contributed to Schaller's net worth. The company's revenue and profitability have grown steadily over the years, generating substantial income for Schaller. Additionally, McFit's strong brand recognition and customer loyalty have made it an attractive investment opportunity, further enhancing Schaller's wealth.

Global Fitness Chain

Rainer Schaller's "Global Fitness Chain" refers to the extensive network of McFit fitness clubs he has established worldwide. This global presence has been a significant contributor to his net worth.

- International Expansion: McFit's expansion into multiple countries has increased its revenue streams and brand recognition. Each new location adds to Schaller's overall wealth.

- Economies of Scale: Operating a global chain allows McFit to leverage economies of scale, reducing costs and increasing profitability. This efficiency contributes to Schaller's net worth.

- Brand Value: McFit's global presence has strengthened its brand value, making it an attractive investment opportunity. This increased brand value translates into higher revenue and ultimately adds to Schaller's net worth.

- Real Estate Holdings: McFit's global operations require a substantial real estate portfolio. These properties are valuable assets that contribute to Schaller's overall wealth.

In conclusion, the global reach of McFit has been a key factor in Rainer Schaller's accumulation of wealth. The international expansion, economies of scale, brand value, and real estate holdings associated with the global chain have all contributed significantly to his net worth.

Real Estate Holdings

Real estate holdings constitute a significant component of Rainer Schaller's net worth. His investments in properties across various locations have played a crucial role in his overall wealth accumulation.

- Strategic Investments: Schaller's real estate investments are often strategically aligned with his business ventures. For instance, McFit fitness clubs are frequently situated in properties owned by Schaller, ensuring cost optimization and operational efficiency.

- Diversification: Real estate serves as a valuable asset class that diversifies Schaller's portfolio. Unlike stocks or bonds, real estate offers tangible assets with the potential for long-term appreciation and rental income.

- Appreciation and Development: Schaller has invested in properties with high appreciation potential. By acquiring land or buildings in prime locations and developing them, he has generated substantial returns on his investments.

- Passive Income: Real estate investments provide passive income through rent. Schaller's extensive property portfolio generates a steady stream of rental income, contributing to his overall net worth.

In summary, Rainer Schaller's real estate holdings represent a significant facet of his net worth. His strategic investments, diversification strategy, and focus on appreciation and development have enabled him to accumulate a substantial portfolio of valuable properties.

Venture Capital Investments

Venture capital investments have played a pivotal role in shaping Rainer Schaller's net worth. His strategic allocation of capital to early-stage companies has contributed significantly to his wealth accumulation.

- High-Growth Potential: Schaller invests in venture capital funds and startups with high-growth potential. These investments offer the opportunity for substantial returns if the companies succeed.

- Diversification: Venture capital investments provide diversification benefits to Schaller's overall portfolio. Unlike traditional investments like stocks and bonds, venture capital offers exposure to a broader range of asset classes and industries.

- Access to Innovation: By investing in early-stage companies, Schaller gains access to innovative technologies and business models. This exposure keeps him at the forefront of industry trends and allows him to identify potential disruptors.

- Long-Term Returns: Venture capital investments typically have a long-term investment horizon. Schaller's patient approach allows him to capture the full potential of his investments as companies grow and mature.

In summary, Rainer Schaller's venture capital investments have been a key driver of his net worth growth. His strategic approach, focus on high-growth potential, and long-term perspective have enabled him to capitalize on the success of innovative companies.

Private Equity Investments

Rainer Schaller's private equity investments have substantially contributed to the growth of his net worth. Private equity involves investing in privately held companies, offering the potential for significant returns.

Schaller's private equity investments have been characterized by several key strategies:

- Growth Capital: Schaller invests in companies with high growth potential, providing them with capital to expand their operations and increase their value.

- Leveraged Buyouts: He has participated in leveraged buyouts, where private equity firms acquire a controlling stake in a company using debt financing.

- Distressed Assets: Schaller has also invested in distressed assets, acquiring companies or assets at a discount and implementing turnaround strategies.

These investments have generated significant returns for Schaller. For example, his investment in the fitness chain McFit, which he later sold, contributed substantially to his net worth.

In summary, Rainer Schaller's private equity investments have been a key driver of his wealth accumulation. His strategic approach, focus on growth potential, and have enabled him to capitalize on the success of private companies.

Philanthropy and Social Impact

Rainer Schaller's engagement in philanthropy and social impact initiatives has played a significant role in shaping his legacy and net worth.

- Community Development: Schaller has supported various community-based organizations and projects aimed at improving the lives of underprivileged populations. His contributions have helped fund initiatives such as housing assistance, education programs, and healthcare services.

- Environmental Conservation: Schaller is an advocate for environmental sustainability and has invested in projects promoting renewable energy, waste reduction, and wildlife conservation. His commitment to preserving the environment aligns with his passion for health and fitness.

- Arts and Culture: Schaller recognizes the importance of arts and culture in society. He has supported cultural institutions, art exhibitions, and educational programs that promote creativity and access to the arts for all.

- Education: Schaller believes in the power of education to transform lives. He has established scholarships and supported educational programs that provide opportunities for individuals to pursue higher education and skills development.

Schaller's philanthropic efforts have not only made a positive impact on society but have also contributed to his net worth. His commitment to social responsibility has enhanced his reputation as a compassionate and socially conscious entrepreneur, attracting investors and business partners who share his values.

Financial Discipline

Financial discipline is a cornerstone of Rainer Schaller's net worth and business success. His prudent financial management and strategic investments have been instrumental in building and preserving his wealth.

Schaller's financial discipline is evident in various aspects of his business operations. He maintains a lean cost structure, emphasizing operational efficiency and cost optimization. This focus on financial prudence has allowed him to reinvest profits back into his businesses, driving growth and expansion.

Furthermore, Schaller has a clear understanding of risk management. He carefully evaluates investment opportunities, conducting thorough due diligence and assessing potential risks. This disciplined approach has enabled him to make informed decisions, mitigating financial losses and safeguarding his net worth.

Schaller's financial discipline extends to his personal life as well. He leads a modest lifestyle, avoiding lavish spending and prioritizing long-term financial security. This disciplined approach has contributed to his overall financial well-being and has allowed him to focus on his business ventures without undue financial pressure.

In conclusion, Rainer Schaller's financial discipline has been a key factor in his net worth growth and business success. His prudent financial management, strategic investments, and commitment to financial responsibility have enabled him to build a solid financial foundation and achieve long-term wealth.

Calculated Risk-Taking

Calculated risk-taking has been a defining characteristic of Rainer Schaller's business ventures and a significant contributor to his net worth. Schaller's ability to assess and manage risk strategically has enabled him to capitalize on opportunities while mitigating potential losses.

One notable example of Schaller's calculated risk-taking is his early investment in the fitness industry. Recognizing the growing demand for affordable fitness facilities, Schaller launched McFit, a low-cost fitness chain that revolutionized the industry. Despite the competitive market, Schaller's strategic approach and calculated risk-taking led to the immense success of McFit, contributing significantly to his net worth.

Schaller's risk-taking extends beyond his core business operations. He has also made strategic investments in real estate, venture capital, and private equity. By carefully evaluating market trends and potential returns, Schaller has been able to identify and capitalize on investment opportunities that have further increased his net worth.

However, calculated risk-taking does not imply recklessness. Schaller thoroughly researches and analyzes potential ventures before committing resources. He understands the importance of risk management and employs strategies to mitigate potential losses. This balanced approach has allowed him to pursue growth opportunities while preserving his wealth.

In summary, Rainer Schaller's calculated risk-taking has been a key factor in his entrepreneurial success and the accumulation of his net worth. His ability to assess and manage risk strategically has enabled him to seize opportunities, innovate, and expand his business empire, solidifying his position as a prominent figure in the business world.

Long-Term Vision

Rainer Schaller's long-term vision has been instrumental in building his substantial net worth. Schaller's ability to think strategically and plan for the future has guided his business decisions and investments, leading to sustained growth and financial success.

One key aspect of Schaller's long-term vision is his focus on creating sustainable businesses. For instance, his fitness chain, McFit, has adopted a low-cost, high-volume business model that makes fitness accessible to a broader customer base. By prioritizing long-term profitability over short-term gains, Schaller has built a business that continues to generate revenue and expand its market share.

Schaller's long-term vision extends to his investment strategy as well. He has invested in real estate, venture capital, and private equity, with a focus on identifying opportunities that have the potential for long-term growth and appreciation. By diversifying his investments and taking a patient approach, Schaller has mitigated risk and increased his net worth over time.

In conclusion, Rainer Schaller's long-term vision has played a crucial role in his financial success. His ability to think strategically, prioritize sustainability, and make well-informed investments has enabled him to build a diversified and resilient portfolio that continues to generate wealth.

FAQs on Rainer Schaller Net Worth

This section provides answers to frequently asked questions regarding Rainer Schaller's net worth, offering insights into his wealth and business ventures.

Question 1: What is Rainer Schaller's estimated net worth?

As of 2023, Rainer Schaller's net worth is estimated to be around 300 million. This substantial wealth has been accumulated through his successful business ventures, primarily in the fitness industry.

Question 2: How did Schaller amass his wealth?

Schaller's wealth is largely attributed to the success of his fitness chain, McFit, which he founded in 1997. McFit's low-cost, high-volume business model has made fitness accessible to a , resulting in significant revenue and expansion.

Question 3: What is the significance of McFit in Schaller's net worth?

McFit has been the cornerstone of Schaller's wealth creation. The company's rapid growth and profitability have contributed substantially to his overall net worth. McFit's strong brand recognition and loyal customer base have also made it an attractive investment opportunity.

Question 4: What other investments have contributed to Schaller's net worth?

In addition to McFit, Schaller has diversified his portfolio through investments in real estate, venture capital, and private equity. His strategic approach to investing has allowed him to capitalize on growth opportunities and further increase his net worth.

Question 5: How does Schaller manage and maintain his wealth?

Schaller is known for his financial discipline and prudent investment strategies. He emphasizes long-term sustainability and risk management, ensuring the preservation and growth of his wealth over time.

Question 6: What is Schaller's legacy beyond his net worth?

While his net worth is a testament to his business acumen, Schaller's legacy extends beyond financial success. He is recognized for his contributions to the fitness industry, making it more accessible and affordable for the masses.

In conclusion, Rainer Schaller's net worth is a reflection of his entrepreneurial spirit, strategic investments, and commitment to long-term value creation. His success serves as an inspiration for aspiring entrepreneurs and business leaders.

Transition to the next article section: Understanding the intricacies of Rainer Schaller's business empire and investment strategies provides valuable insights into wealth creation and financial management.

Tips on Building Wealth Inspired by Rainer Schaller's Business Acumen

Entrepreneurs and investors can draw valuable lessons from Rainer Schaller's business strategies and investment approach to build wealth and achieve financial success.

Tip 1: Identify Market Opportunities: Schaller recognized the growing demand for affordable fitness facilities and capitalized on it by founding McFit. Identifying unmet market needs and developing innovative solutions can lead to significant growth potential.

Tip 2: Focus on Operational Efficiency: McFit's low-cost business model emphasizes cost optimization and operational efficiency. By minimizing expenses and maximizing revenue, businesses can increase profitability and long-term sustainability.

Tip 3: Embrace Calculated Risk-Taking: Schaller's strategic investments in real estate, venture capital, and private equity demonstrate his willingness to take calculated risks. Thorough research and risk management are essential for making informed investment decisions.

Tip 4: Diversify Your Portfolio: Schaller's diversified portfolio across various asset classes reduces risk and enhances the potential for long-term wealth growth. Diversification strategies can help mitigate market fluctuations and preserve capital.

Tip 5: Invest in Long-Term Value: Schaller's focus on sustainable business practices and long-term growth ensures the longevity of his ventures. Prioritizing quality over short-term gains can lead to enduring success and financial stability.

By implementing these principles inspired by Rainer Schaller's business acumen, entrepreneurs and investors can enhance their strategies, increase their wealth-building potential, and achieve long-term financial success.

Transition to the article's conclusion: Understanding and applying these tips can empower individuals to make informed financial decisions and build a solid foundation for their financial future.

Rainer Schaller Net Worth

Rainer Schaller's net worth stands as a testament to his exceptional entrepreneurial skills and strategic investment approach. His ability to identify market opportunities, optimize operations, and embrace calculated risk-taking has been instrumental in building his wealth and business empire.

Schaller's success serves as an inspiration for aspiring entrepreneurs and investors alike. By understanding the principles that have guided his business decisions and investment strategies, individuals can enhance their financial acumen and increase their potential for long-term wealth creation.

Unveiling The Enigmatic Gilles Dufour: Catherine Deneuve's Longtime Companion

Unveiling The Influence Of Justin Hakuta's Parents: A Journey Of Discovery

Unveiling The Exceptional Stature Of James Holzhauer: Discoveries And Insights

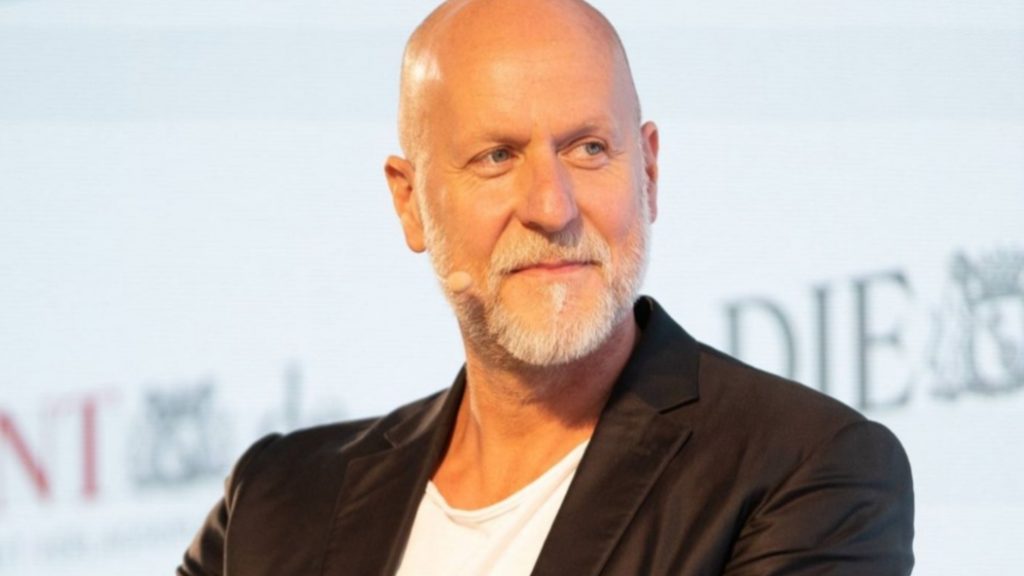

The CEO of The RSG Group Rainer Schaller Net Worth at The Time of His

Rainer Schaller's Net Worth (Updated 2024)

Rainer Schaller Net Worth OtakuKart

ncG1vNJzZmion6rApr%2BNmqSsa16Ztqi105qjqJuVlru0vMCcnKxmk6S6cL7AoqWeql2osKmty6Wcq2WemsFuw86rq6FmmKm6rQ%3D%3D