Jack Welch Net Worth refers to the accumulated wealth of former General Electric CEO, Jack Welch. As of 2023, his net worth is estimated to be around $750 million, according to Forbes.

Welch's wealth primarily stems from his successful career at General Electric, where he served as CEO from 1981 to 2001. During his tenure, he implemented various strategies that led to significant growth and profitability for the company. Welch's leadership and management style, known as "Neutron Jack," focused on maximizing shareholder value and fostering a culture of performance and innovation.

After retiring from GE, Welch continued to engage in business ventures and investments. He authored several books on leadership and management, which became bestsellers. Welch's net worth reflects his successful career as a business executive, author, and investor.

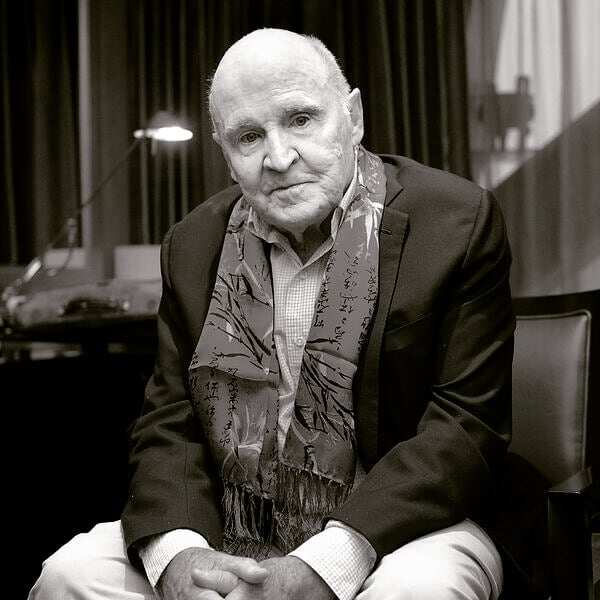

Jack Welch Net Worth

Jack Welch's net worth, estimated at $750 million, reflects his successful career as a business executive, author, and investor. Key aspects of his wealth include:

- GE Leadership: Welch's tenure as CEO of General Electric (GE) from 1981 to 2001 led to significant growth and profitability for the company.

- Management Style: Welch's "Neutron Jack" leadership style focused on maximizing shareholder value and fostering a culture of performance and innovation.

- Business Ventures: After retiring from GE, Welch continued to engage in business ventures and investments, further increasing his wealth.

- Book Sales: Welch authored several best-selling books on leadership and management, generating substantial income.

- Investments: Welch's investments in various sectors, including technology and healthcare, have contributed to his net worth.

- Stock Options: As CEO of GE, Welch received significant stock options, which increased in value over time.

- Real Estate: Welch owns several properties, including a mansion in Massachusetts and an apartment in New York City.

- Art Collection: Welch is an avid art collector, and his collection includes works by renowned artists.

- Philanthropy: Welch has donated millions of dollars to various charitable causes, including education and healthcare.

These key aspects highlight the diverse sources of Welch's wealth, which stems from his successful leadership at GE, business ventures, investments, and other sources of income. His net worth is a testament to his entrepreneurial spirit, business acumen, and commitment to maximizing shareholder value.

| Name | Jack Welch |

|---|---|

| Birth Date | November 19, 1935 |

| Birth Place | Salem, Massachusetts, U.S. |

| Alma Maters | University of Massachusetts Amherst, University of Illinois |

| Occupation | Business Executive, Author, Investor |

| Net Worth | $750 million (estimated) |

GE Leadership

Welch's leadership at GE played a pivotal role in his net worth accumulation. During his tenure, he implemented various strategies that transformed the company into a global powerhouse.

- Six Sigma Quality: Welch introduced Six Sigma, a quality management methodology that focused on reducing defects and improving efficiency. This led to significant cost savings and increased productivity for GE.

- Employee Performance Reviews: Welch implemented a rigorous performance review system that rewarded top performers anded underperformers. This created a culture of accountability and high performance, driving the company's success.

- Globalization: Welch expanded GE's global presence, particularly in emerging markets. This diversification strategy opened new revenue streams and contributed to the company's growth.

- Business Portfolio Optimization: Welch sold or spun off non-core businesses and acquired companies that aligned with GE's strategic direction. This focused approach enhanced the company's profitability and market position.

Welch's leadership transformed GE into one of the world's most successful and profitable companies. The increased shareholder value and profitability during his tenure significantly contributed to his net worth.

Management Style

Welch's "Neutron Jack" leadership style played a significant role in his net worth accumulation. By maximizing shareholder value and fostering a culture of performance and innovation at GE, he created a highly profitable and successful company.

Welch's focus on shareholder value meant that he made decisions based on what would benefit the company's owners in the long run. This led to a focus on profitability, efficiency, and growth. Welch's performance-oriented culture rewarded employees for their contributions and encouraged them to constantly improve. This led to a highly motivated and productive workforce that drove GE's success.

Welch's leadership style also fostered a culture of innovation. He encouraged employees to take risks and come up with new ideas. This led to the development of new products and services that contributed to GE's growth. Welch's ability to create a high-performance culture that focused on innovation and shareholder value was a key factor in his success and ultimately his net worth.

The connection between Welch's management style and his net worth is clear. By creating a company that was profitable, efficient, and innovative, Welch increased the value of GE's stock. This, in turn, led to a significant increase in his net worth.

Business Ventures

Jack Welch's business ventures after retiring from GE played a significant role in increasing his net worth. He invested in various sectors, including technology, healthcare, and energy. These investments were often in early-stage companies with high growth potential. Welch's business acumen and experience in identifying successful businesses allowed him to generate substantial returns on his investments.

One notable investment was Welch's involvement in the founding of the private equity firm Clayton, Dubilier & Rice (CDR). CDR has invested in numerous successful companies, including The Hertz Corporation, Rexel, and Getty Images. Welch's involvement in CDR and his ability to identify and invest in high-growth companies contributed significantly to his net worth.

In addition to private equity investments, Welch also invested in public markets. He was an early investor in Amazon and Google, two companies that have experienced tremendous growth and success. Welch's foresight in recognizing the potential of these companies further increased his net worth.

Welch's business ventures after retiring from GE demonstrate his continued entrepreneurial spirit and his ability to generate wealth through investments. His success in identifying and investing in high-growth companies, both in the private and public markets, has been a significant factor in his net worth accumulation.

Book Sales

The connection between Jack Welch's book sales and his net worth is significant. Welch's books have been highly successful, selling millions of copies worldwide. This success has generated substantial income for Welch, contributing to his overall net worth.

Welch's books are highly regarded for their insights on leadership and management. He shares his experiences and lessons learned from his time as CEO of General Electric. His books have become essential reading for business leaders and professionals seeking to improve their skills. The popularity and credibility of Welch's books have made them a valuable asset, generating significant income for him.

Welch's book sales have not only contributed to his net worth but have also enhanced his reputation as a thought leader in the business world. His books have helped to establish him as an expert in leadership and management, which has led to speaking engagements, consulting work, and other opportunities that have further increased his wealth.

In summary, the connection between Welch's book sales and his net worth is clear. His successful books have generated substantial income for him, contributing to his overall wealth. Additionally, his books have enhanced his reputation as a thought leader, leading to further financial opportunities.

Investments

Jack Welch's investments have played a significant role in his net worth accumulation. After retiring from General Electric, Welch invested in various sectors, including technology and healthcare, through private equity firms and public market investments. These investments have generated substantial returns, contributing to his overall wealth.

Welch's investment strategy has been characterized by a focus on high-growth companies with strong potential for value creation. He has invested in early-stage companies, such as the private equity firm Clayton, Dubilier & Rice, and public companies, such as Amazon and Google. Welch's ability to identify and invest in successful businesses has been a key factor in his investment success.

The practical significance of understanding the connection between Welch's investments and his net worth lies in recognizing the importance of strategic investment for wealth creation. Welch's investments have not only generated income but have also contributed to his reputation as a successful investor. This reputation has led to further investment opportunities and collaborations, enhancing his overall net worth.

Stock Options

The connection between Welch's stock options and his net worth is significant. As CEO of General Electric (GE), Welch received substantial stock options as part of his compensation package. These options gave him the right to purchase GE shares at a predetermined price, regardless of the market price.

During Welch's tenure as CEO, GE's stock price increased significantly, leading to a substantial increase in the value of his stock options. When Welch exercised his options, he was able to sell the shares at a profit, contributing to his overall net worth.

The importance of Welch's stock options lies in their role as a significant component of his compensation package. Stock options provide executives with an incentive to increase the company's stock price, aligning their interests with those of shareholders. In Welch's case, the increase in GE's stock price not only benefited the company's shareholders but also significantly increased his personal wealth.

Understanding the connection between stock options and executive compensation is crucial for assessing the overall compensation structure of companies. Stock options can be a powerful tool for motivating executives to drive long-term shareholder value, but they also raise potential concerns about excessive executive pay and misalignment of incentives.

Real Estate

Real estate investments have contributed significantly to Jack Welch's net worth. Welch owns a diverse portfolio of properties, including a mansion in Massachusetts and an apartment in New York City.

- Appreciation and Rental Income: Real estate investments often appreciate in value over time, generating long-term wealth for owners. Additionally, properties can be rented out, providing a steady stream of passive income.

- Diversification: Real estate offers diversification benefits within an investment portfolio. Unlike stocks or bonds, real estate is less correlated to market fluctuations.

- Tax Benefits: Real estate investments can provide tax benefits, such as mortgage interest deductions and depreciation allowances.

- Tangible Asset: Real estate is a tangible asset that provides a sense of security and stability, unlike more abstract investments like stocks.

The combination of these factors has made real estate a valuable asset class for Welch, contributing to his overall net worth. Real estate investments have provided him with long-term capital appreciation, rental income, diversification, tax benefits, and a sense of tangible ownership.

Art Collection

Jack Welch's art collection holds significant value within his overall net worth. As an avid art collector, Welch has amassed a collection of works by renowned artists, contributing to his wealth in several ways:

- Appreciation and Investment Return: Fine art is often considered an alternative investment, with the potential for significant appreciation in value over time. Welch's collection includes works by established and emerging artists, whose works have the potential to increase in value, contributing to his net worth.

- Diversification: Art can provide diversification benefits within an investment portfolio. Unlike traditional stocks or bonds, the art market has a low correlation to other asset classes, reducing overall portfolio risk.

- Tax Benefits: In some jurisdictions, art collections may qualify for tax benefits, such as reduced capital gains taxes or estate taxes. These benefits can help preserve and enhance the value of Welch's art collection.

- Cultural Significance: Welch's art collection reflects his personal taste and cultural interests. Owning and appreciating fine art can be a source of personal fulfillment and enrichment, adding intangible value to his life.

Understanding the connection between Welch's art collection and his net worth highlights the multifaceted nature of wealth accumulation. Beyond traditional investments and business ventures, collecting art can be a strategic and personally rewarding way to enhance and diversify one's financial portfolio.

Philanthropy

Philanthropy plays a significant role in understanding Jack Welch's net worth as it demonstrates a commitment to social responsibility and giving back to the community. Welch's charitable contributions, totaling millions of dollars, are directed towards causes that align with his values and passions, particularly in the areas of education and healthcare.

By supporting educational initiatives, Welch invests in the future generations, recognizing the importance of accessible and quality education for societal progress. His donations to healthcare organizations reflect his concern for the well-being of the community and contribute to advancements in medical research and patient care. These philanthropic endeavors not only make a tangible difference in the lives of others but also enhance Welch's legacy as a socially conscious individual.

Moreover, Welch's philanthropy contributes to his net worth by demonstrating his character and values. It showcases his commitment to using his wealth for positive change, which is attractive to investors and business partners who seek ethical and responsible collaborations. Additionally, his charitable contributions may provide tax benefits, further impacting his financial standing.

In summary, Welch's philanthropy is an integral aspect of his net worth, reflecting his values, social responsibility, and commitment to making a positive impact on society. His charitable donations enhance his legacy, attract ethical partnerships, and contribute to his overall financial well-being.

Jack Welch Net Worth FAQs

This section addresses common questions and misconceptions surrounding Jack Welch's net worth:

Question 1: How did Jack Welch accumulate his wealth?

Jack Welch's net worth primarily stems from his successful career at General Electric (GE), where he served as CEO from 1981 to 2001. Under his leadership, GE experienced significant growth and profitability. Additionally, Welch's investments in various sectors, including technology and healthcare, contributed to his wealth.

Question 2: What is the estimated value of Jack Welch's net worth?

As of 2023, Jack Welch's net worth is estimated to be around $750 million, according to Forbes.

Question 3: Did Welch's leadership style contribute to his net worth?

Yes, Welch's "Neutron Jack" leadership style, focused on maximizing shareholder value and fostering a culture of performance and innovation, played a significant role in GE's success and ultimately his personal wealth.

Question 4: How did Welch's investments impact his net worth?

Welch's investments in various sectors, including private equity firms and public markets, such as Amazon and Google, were highly successful and contributed substantially to his net worth.

Question 5: What is the significance of Welch's real estate holdings in his net worth?

Welch's ownership of multiple properties, including a mansion in Massachusetts and an apartment in New York City, contributes to his overall net worth through appreciation, rental income, and diversification benefits.

Question 6: How does Welch's philanthropy impact his net worth?

While Welch's charitable contributions do not directly increase his net worth, they demonstrate his commitment to social responsibility and may provide tax benefits, indirectly affecting his financial standing.

In summary, understanding the key factors that contributed to Jack Welch's net worth provides insights into his successful career, investment strategies, and personal values.

Transition to the next article section:

Tips for Understanding Jack Welch's Net Worth

Jack Welch's net worth is a testament to his successful career, investments, and business acumen. To gain a comprehensive understanding of his wealth, consider the following tips:

Tip 1: Analyze Welch's Leadership at GE:Examine his "Neutron Jack" management style and its impact on GE's growth, profitability, and shareholder value. This will shed light on the foundation of his wealth accumulation.

Tip 2: Evaluate Welch's Investment Strategies:Research Welch's investments in various sectors, including technology, healthcare, and private equity. Identify the factors that contributed to the success of his investment decisions.

Tip 3: Consider Welch's Real Estate Holdings:Understand the value of Welch's real estate portfolio, including his mansion in Massachusetts and apartment in New York City. Explore how these properties contribute to his net worth through appreciation, rental income, and diversification.

Tip 4: Examine Welch's Philanthropic Contributions:While philanthropy does not directly increase net worth, it provides insights into Welch's values and commitment to social responsibility. Analyze the impact of his donations to education and healthcare.

Tip 5: Study Welch's Book Sales and Speaking Engagements:Assess the revenue generated from Welch's best-selling books and speaking engagements. Understand how these activities contributed to his overall wealth.

Summary: By following these tips, you can gain a deeper understanding of the key factors that shaped Jack Welch's net worth. These insights highlight the multifaceted nature of wealth creation and the strategies employed by successful business leaders.

Conclusion

The exploration of Jack Welch's net worth reveals the multifaceted nature of wealth creation. His successful leadership at General Electric, strategic investments, and various business ventures have played significant roles in accumulating his fortune. Welch's understanding of market trends, ability to identify high-growth opportunities, and commitment to maximizing shareholder value have been key drivers of his financial success.

Moreover, Welch's net worth extends beyond monetary value. His philanthropic endeavors, real estate holdings, and book sales underscore his commitment to social responsibility, diversification, and sharing his knowledge. By analyzing the factors that have shaped Welch's net worth, we gain valuable insights into the strategies and principles that have enabled him to achieve financial success and make a lasting impact on the business world.

Unlock Surprising Truths: Dive Into The Age Of Freddie Freeman's Wife

Unveil The Secrets Of "jackie Gansky Only Fans": Exclusive Access And Insider Tips

Meet The Three Amazing Kids Of Jennifer Aydin!

ncG1vNJzZmibkZm6ra2RZ6psZqWoerix0q1ka2aRoq67u82arqxmk6S6cLbAnKJmr5WhsKl5zZ6rZq%2Bfp8GpesetpKU%3D